You should consult & consider hiring a FINRA arbitration lawyer to represent you during securities arbitration or mediation. Keep in mind that if you choose to represent yourself, most brokerage firms have their own attorneys.

If you have significant investment losses due to actions or negligence by your broker and/or their employer, you can file a claim with FINRA.

Note: Filing a claim with FINRA is crucial, but we would also advise that you speak to a securities attorney experienced in FINRA arbitration cases. These attorneys handle similar cases every day, and they will be able to give you clearer advice on your rights, what damages you can expect to recover, and whether or not you have a case.

A securities attorney will also be able to help you with the filing of the claim itself. If the claims are denied (which is common), the attorney can advise you on how best to proceed.

The FINRA arbitration lawyers at The Law Offices of Robert Wayne Pearce, P.A. have been helping investors nationwide recover their losses since 1980. The FINRA arbitration process can be confusing and lengthy, but this experienced securities attorney will help you throughout the entire process.

The securities arbitrations handled by the attorneys at our firm, generally involve securities broker-dealers who are members or individuals who are associate members of FINRA. Because of this, our explanation of arbitration will focus on FINRA arbitration proceedings.

Attorney Pearce has arbitrated and mediated numerous FINRA disputes involving complex legal issues in his practice areas.

To learn more about our FINRA arbitration and alternative dispute resolution services, contact us online or call (800) 732-2889 today to schedule a confidential consultation.

Key Takeaways

- If you have suffered losses due to your broker’s actions or negligence, you can file a claim with FINRA.

- It is recommended that you consult with an attorney experienced in securities arbitration cases before filing a claim.

- The formal arbitration process begins with the filing of a statement of claim by the investor or their attorneys.

- Most arbitration proceedings take 12 to 16 months from start to finish.

- If the respondent brokerage firm loses the arbitration, they are given 30 days to make payment.

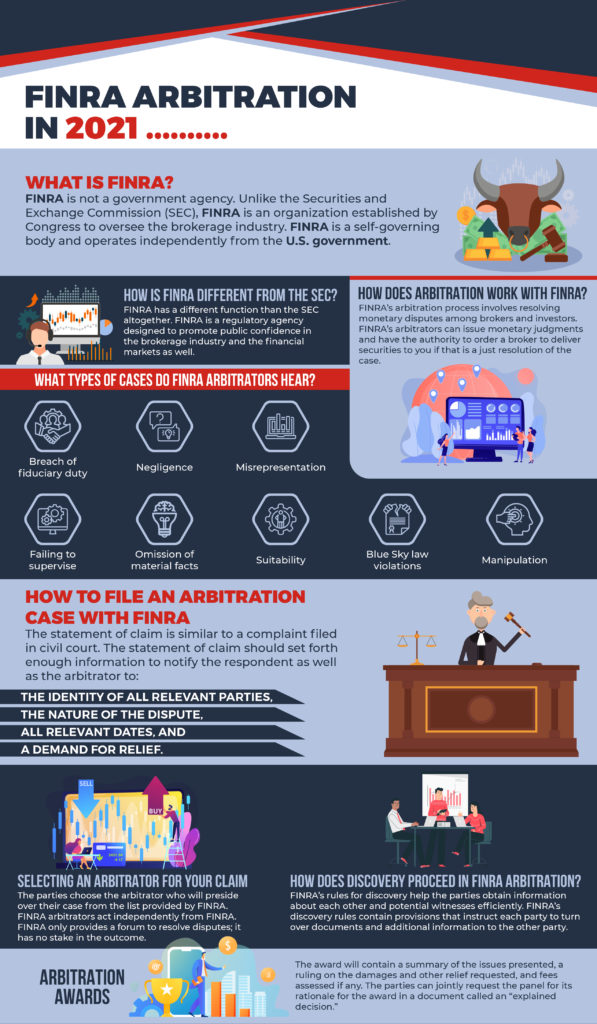

What is FINRA Arbitration?

FINRA ATTORNEYS SERVING CLIENTS IN ARBITRATIONS NATIONWIDE

More and more disputes are being resolved in alternative dispute resolution (ADR) forums these days. The primary ADR methods are arbitration and mediation.

Whether you are an investor or a broker, the odds are that you have agreed in an account opening agreement or self-regulatory organization membership agreement.

This is done to resolve any dispute with any stock or commodities brokerage firm in an arbitration forum outside the courtroom such as:

- The Financial Industry Regulatory Authority (FINRA),

- National Futures Association (NFA),

- American Arbitration Association (AAA), or

- The Judicial Arbitration and Mediation Services (JAMS) organizations at locations throughout the United States.

Arbitration is generally a more expeditious and economical dispute resolution process than courtroom litigation. It can go on for years and be very expensive to comply with court rules and pretrial discovery procedures such as depositions, interrogatories and examinations, which do not generally take place in arbitration.

Arbitrations are generally not open to the public.

The documents and testimony presented are held in a confidential manner by:

- The forum,

- Parties pursuant to the rules of the arbitration forum, and

- The parties agreement to arbitrate their dispute.

The only document that is generally made public is the Award itself, which the parties may take and file in court if necessary to enforce the Award by confirming it to a Final Judgment.

The Arbitrators

In most arbitrations, lawyers, accountants and other business persons decide disputes between two or more parties in a business setting instead of having a judge or jury decide your dispute in a courtroom.

The individuals who decide these disputes are generally experienced in the particular industry in which the dispute has arisen. These individuals are generally selected by the parties and compose an arbitration panel that is charged with the responsibility of making a fair and final decision related to the dispute.

These arbitrators will review the parties’ papers or pleadings outlining the claims and defenses related to the dispute, conduct a hearing where the parties present documents as evidence and witnesses who give testimony as evidence in a manner less formal than a courtroom.

The arbitrators then listen to the factual and legal arguments of the parties and make a decision to fully resolve the dispute.

FINRA and NFA provide the primary dispute resolution services for their members and their customers who invest in the securities and commodities markets. The majority of arbitration claims involving the securities industry are filed with FINRA.

Commodities industry disputes are generally processed in a similar manner and under the rules of the NFA.

The FINRA Arbitration Process

If you are an investor or a stockbroker, the FINRA arbitration process began when you opened your account at, or became associated with a stock brokerage firm and signed an account opening agreement or employment agreement, respectfully.

Virtually all agreements with all brokerage firms contain an agreement to arbitrate all controversies and disputes you may have with the brokerage firm. In those agreements, you agree to abide by the rules of FINRA, particularly the FINRA Code of Arbitration Procedure (the FINRA Code”) and waive a right to have your dispute resolved in a court of law before a judge or jury.

The FINRA Code sets forth all of the procedures and rules governing the arbitration. It describes the controversies that are eligible for arbitration and those that are not subject to the arbitration agreement. There are general arbitration rules governing the parties’ conduct in arbitration. The FINRA Code prescribes the minimum content and when to file a claim, counterclaim, cross-claim and third party claim and answer to any and all those types of claims.

There are rules governing the appointment, disqualification and authority of arbitrators along with prehearing procedures and discovery rules. There are rules governing the conduct of the hearing, the type of evidence that may be presented and the manner in which the hearing is concluded.

The FINRA Code sets forth the fee schedule and the manner in which the Award is issued by the arbitrators to the parties.

Filing a FINRA Arbitration Claim

The formal arbitration process begins with the filing of a statement of claim by you or your attorneys.

The investor who files the claim is referred to as the “Claimant” in the arbitration proceeding.

If you are an investor, the statement of claim is the most important document in your case.

This document describes what happened and why you or your FINRA arbitration attorney believe you are entitled to win a monetary award or other relief against the brokerage firm.

This is the document that will provide the arbitrators with their first and most important impressions of you and your case against the brokerage firm.

It is important that you and/or your lawyers write a clear, concise, accurate, and honest account of what happened and a compelling argument for why you should win the arbitration.

FINRA Arbitration Fees

FINRA charges you for its services. There are a nonrefundable filing fees to initiate the arbitration depending on the size of your monetary claim ranging from $50 to $1,800 for investors and stockbrokers who initiate claims against brokerage firms.

The fees for disputes initiated by member brokerage firms are greater and range from $225 to $3,700 and those member firms can be surcharged for additional amounts when they become parties to arbitration proceedings.

Submitting the FINRA Arbitration Claim

The arbitration claims can be filed in writing and mailed to the main FINRA office in New York City or filed electronically. FINRA is in the process of going totally paperless for their convenience as well as for the convenience of the parties and arbitrators.

Answering the Statement of Claim

The brokerage firm is referred to as the “Respondent” in the arbitration proceeding. Once filed, the claim is served by FINRA on the brokerage firm with instructions to the Respondent to file an answer within 45 business days.

If you are responding to an arbitration claim, it is equally important to file a clear, concise, accurate, and honest account of what happened along with a compelling legal argument as to why the claims made against you have no basis in law or fact, and justify a dismissal in the final Award.

The FINRA Arbitration Hearing

The type of arbitration hearing conducted can vary depending on the size of the arbitration claim.

Arbitration Claims of $100,000 or Less

If your claim is for a monetary award less than $100,000, it is a “small claim” that is usually decided by a single public arbitrator.

If the claim is under $50,000, the arbitrator will generally render a decision based solely upon the content of the written statements and the supporting documents submitted by each party without any testimony.

If the claim is between $50,000 and $100,000, the single arbitrator will conduct a hearing where you and your witnesses appear and give testimony and introduce documents into evidence for that single arbitrator’s consideration and decision. A panel may also consist of three arbitrators if the parties agree in writing.

Arbitration Claims over $100,000

If the claim exceeds $100,000, three arbitrators will be appointed to hear the testimony and resolve your claim based upon all of the evidence. An Award is entered based upon a majority vote by the arbitrators in your case.

Where Will the Hearing Take Place?

The final arbitration hearing takes place in either one of FINRA’s regional offices or one or more hearing sites selected by FINRA in the state where you reside.

How Long Will the Arbitration Hearing Take?

Depending on where you reside and the number of claims filed, the time it takes from the filing of a claim to the conduct of a final hearing where your dispute is heard and resolved is 12 to 16 months.

Most arbitration proceedings involving larger claims and 3 or more arbitrators take 3 to 5 consecutive days, but it is not unheard of for some very complex and large claims to take weeks to be heard.

There are generally two 4-hour hearing sessions during each hearing day. At the end of the presentation of evidence, the arbitrators will decide the case privately in additional hearing sessions.

How Does the Arbitration Process Work?

In three-person Arbitration Panels, a qualified Chairperson will be appointed as a spokesperson for the entire arbitration panel and be the arbitrator directing the conduct of the hearing.

The Chairperson will begin the arbitration hearing by reading formal notices to the parties and requiring each arbitrator and person present, who will testify as a witness, to be sworn in under oath as an arbitrator or witness.

Each party with a lawyer will then make a brief opening statement of what they intend to prove at the hearing.

The Claimant or his/her lawyer then begins to present the evidence through witnesses giving live testimony and documents to prove the claims. Some witnesses may appear by video conference or telephone if they are not within the locale and are permitted to do so by the arbitrators.

After the Claimant and his/her witnesses testify, the Respondent or his/her lawyers may question the witnesses. The arbitrators can ask questions of the witnesses at any time during the testimony but usually wait until the parties or their attorneys finish their examination of the parties and non-party witnesses.

After the Claimant presents all of the evidence in support of his/her claims, the Respondent presents his/her defense in the same manner.

At the conclusion of the Respondent’s case, the parties or their attorneys may present closing statements, which are summations of the testimony and documents introduced into evidence and arguments as to why their side should win the case.

Decision and Award

The Arbitration Panel’s decision is called an “Award,” which is final and binding on the parties unless it is successfully challenged in court on limited grounds within a statutory time period.

The Award is made after all the parties complete the presentation of the evidence and the arbitrators close the record and deliberate privately to reach a decision of the majority of the members of the Arbitration Panel.

The arbitrators, with the assistance of the FINRA administrative staff, will prepare the Award generally within 30 days of the close of the record.

The Award will include the following information:

- Identify the parties,

- Generally describe the claims and defenses and state who prevailed on each claim, and

- The amount to be awarded, if anything, to the Claimant or Counterclaimant in the dispute OR order a dismissal of all claims, meaning the Respondent prevailed.

The arbitrators will then assess the fees and expenses of the arbitration proceeding against one or more parties. Generally, the arbitration hearing session fees and expenses are ordered to be split 50-50 by the parties. The Award is then mailed to the parties or their attorneys.

Collecting the Arbitration Award

If the brokerage firm loses the arbitration, it is given 30 days to make payment.

If the respondent fails to pay the award within 30 days, the Claimant may petition FINRA to suspend the brokerage firm or broker’s license, and petition the courts to confirm the arbitration award to a Final Judgment in order to collect the amount due through attachment, levy, and garnishment proceedings.

Do You Need a Lawyer for FINRA Arbitration?

Even though you do not need a lawyer to file a claim with FINRA, FINRA recommends that you consider hiring a lawyer to represent you during arbitration or mediation. Since brokerage firms have their own attorneys to represent them throughout the securities arbitration process, it is highly recommended that you hire an experienced FINRA attorney to represent your interests.

If you have suffered significant investment losses due to your broker’s actions or negligence, then you should consider filing a claim with FINRA. Our FINRA arbitration lawyers can help you file the claim and also help you recover any damages that may be owed as a result of your investment losses.

We have a history of successfully representing investors in FINRA arbitrations, and we have handled numerous complex securities issues over the years. Don’t wait to take action–call our office today at (800) 732-2889 and learn how we can help you recover your losses.

You Don’t Need to Find a FINRA Lawyer “Near Me”

FINRA arbitration and proceedings are handled on a national level, so you don’t need to worry about only being able to find “FINRA attorneys near me.” This is beneficial for investors as they can hire a securities attorney with the experience and past success they are looking for, regardless of where they live.

The Securities and Exchange Commission (SEC) offers the following tips on finding an attorney specializing in securities complaints:

- Schedule a consultation with a lawyer who specialized in securities arbitration or litigation to talk about your options and whether or not you need a lawyer for your case.

- Most lawyers will offer consultations to investors for free or for a minimal fee.

- You should broaden your search beyond FINRA lawyers in your local area. The Martindale-Hubbell® Law Directory has listings of lawyers that are organized by state and city. You can view our listing on Martindale-Hubbell® here.

You can also contact your state or local bar association to find a lawyer in your area. Below are the names of two national bar associations that can help you find the right attorney for your case:

If you have any other questions about FINRA arbitration, an experienced FINRA lawyer at The Law Offices of Robert Wayne Pearce, P.A. can help you throughout the entire process.

To learn more about our FINRA arbitration services, contact us online or call (800) 732-2889 today to schedule a consultation and get started on your case.

Don’t Wait—Learn How a Securities Arbitration & FINRA Attorney Can Help You

If you have suffered significant investment losses as a result of your broker’s actions or negligence, then you should consider filing a claim with FINRA. Our securities FINRA arbitration lawyers can help you file the claim and represent your interests throughout the entire process.

You can contact one of our qualified attorneys today at (800) 732-2889 to discuss your case and learn more about how we can help you get the compensation that you deserve.

Brokerage firms can be held liable for their actions, and our goal is to hold them responsible. We have a history of successfully representing investors in FINRA arbitrations, and we will work tirelessly to help you recover your losses.

For over 45 years, the FINRA attorney at The Law Offices of Robert Wayne Pearce, P.A. has been devoted to helping investors recover their losses due to investment fraud or negligence by their broker or brokerage firm.

Lead attorney Robert Wayne Pearce and his legal team have experience handling all types of investment-related disputes, and they are prepared to help you too.

Contact him today by sending an online message or calling (561) 338-0037 to see how an FINRA attorney can help you get the recovery you need and deserve.

Free Initial Consultation with FINRA Arbitration Attorneys Who Can Handle Your Investment Loss Problems

The Law Offices of Robert Wayne Pearce, P.A. understands the arbitration process and knows what is at stake in securities, commodities and investment law matters and constantly strives to secure the most favorable possible result.

Mr. Pearce provides a complete review of your case and fully explains your legal options. The firm works to ensure that you have all of the information necessary to make a sound decision before any action is taken in your case.

For dedicated representation by a law firm with substantial experience in all kinds of securities, commodities and investment disputes, contact the firm by phone at (561) 338-0037, toll free at 800-732-2889 or via e-mail.

We can also arrange a meeting with you at offices located in Boca Raton, Fort Lauderdale, Miami and West Palm Beach, Florida and elsewhere if we believe you have a viable case or defense.