This is your definitive guide to FINRA arbitration in 2024.

In this article you will learn: how disputes are handles under FINRA arbitration, the FINRA arbitration process, and what to expect if you are involved in a FINRA arbitration case.

We will also cover the most important information that you will need to know about FINRA arbitration in 2024 so that you can be prepared if you find yourself involved in a case.

What is FINRA Arbitration?

FINRA arbitration is a forum for resolving disputes between investors and their brokerage firms or brokers, outside of court. It involves presenting evidence and arguments to a panel of arbitrators, who make a binding decision, called an award, on the dispute.

Need Legal Help? Let’s talk.or, give us a ring at 561-338-0037.

As an investor, if you have suffered considerable investment losses caused by the behavior of your broker, then FINRA arbitration may be a viable solution. By filing for arbitration with FINRA, you could be entitled to recoupment or compensation from the brokerage firm responsible.

It is highly recommended by FINRA that all investors seek the advice of a qualified FINRA attorney before filing for arbitration.

FINRA Overview

FINRA, the acronym for Financial Industry Regulatory Authority, governs disputes between investors and brokers and disputes between brokers. In this article, we solely concentrate on how an individual private investor files a claim to recover losses against their broker or financial advisor.

We will explain how FINRA fits into the securities regulatory scheme. We will discuss how FINRA provides services designed to resolve disputes in a cost-effective manner that is quicker than a traditional court and give some insight into how FINRA‘s arbitration procedure works.

Next, we will examine the pros and cons of FINRA arbitration. Lastly, we will discuss how a highly experienced lawyer who has represented numerous clients successfully at FINRA arbitration can help you recover your damages from your broker or financial advisor.

What Is FINRA?

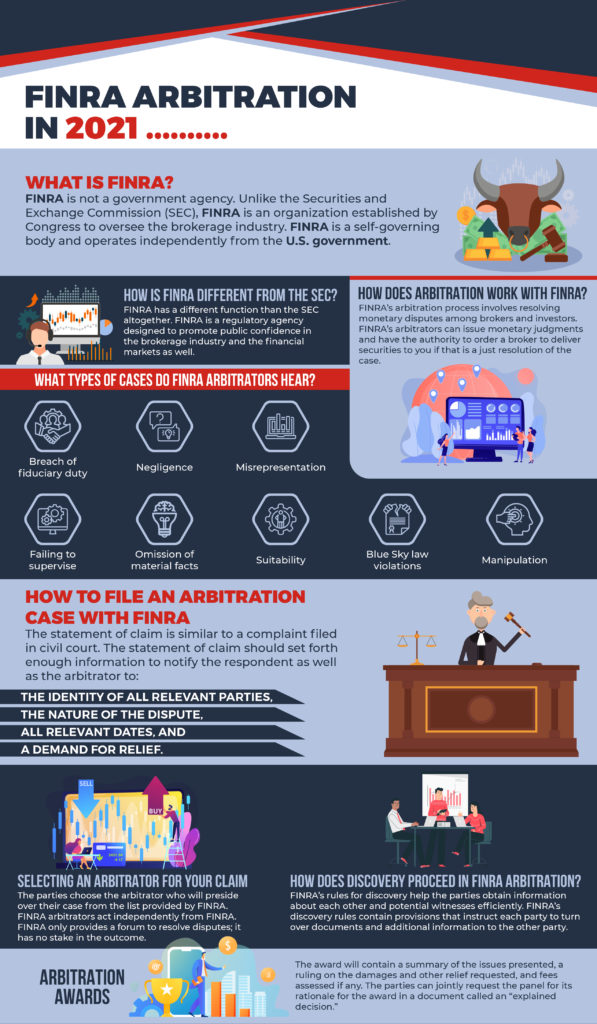

FINRA is not a government agency. Unlike the Securities and Exchange Commission (SEC), FINRA is an organization established by Congress to oversee the brokerage industry. FINRA is a self-governing body and operates independently from the U.S. government.

By contrast, the SEC more broadly regulates the buying and selling of securities on various exchanges such as the New York Stock Exchange, NASDAQ, and the American Stock Exchange. The SEC approves initial public offerings and secondary offerings and can halt trading to avoid a crash if necessary.

Additionally, the SEC has law enforcement powers. Along with the FBI and the U.S. Attorneys Office, the SEC can investigate acts surrounding the buying, selling, and issuing of securities. The U.S. Attorney can pursue charges for crimes relating to the stock market, such as insider trading and wire fraud.

While the SEC has the authority to file civil lawsuits against any person or organization violating the securities statutes and the SEC’s rules.

How Is FINRA Different from the SEC?

FINRA has a different function than the SEC altogether. FINRA is a regulatory agency designed to promote public confidence in the brokerage industry and the financial markets as well. People will not invest if they believe they have trusted unscrupulous financial advisors to protect their economic interests.

FINRA ensures that its members comply with the ethical rules of their profession, similar to a state bar for attorneys or a board of registration for medical professionals.

Congress granted FINRA authorization to investigate complaints investors make concerning misconduct, fraud, or potentially criminal behavior. As a result, FINRA can discipline its members if the agency determines that a broker violated its professional code.

FINRA can assess fines, place restrictions on a broker’s authority, or expel the member from its ranks for an egregious violation. Anyone who suspects their broker or their financial advisor of wrongdoing should file a complaint with FINRA’s complaint center for investors.

You should be aware that FINRA’s rules do not restrict you from filing a complaint seeking an investigation into wrongdoing and pursuing monetary damages in arbitration.

Investment Losses? We Can Help

Discuss your legal options with an attorney at The Law Offices of Robert Wayne Pearce, P.A.

or, give us a ring at (800) 732-2889.

FINRA Alternative Dispute Resolution

FINRA provides a forum for investors to resolve their disputes with their brokers or financial advisors. In fact, FINRA boasts the largest securities dispute resolution forum in the US. FINRA offers arbitration services, as well as mediation services, as a means to avoid costly and inefficient litigation in courts.

FINRA provides a fair, effective, and efficient forum to resolve broker disputes. FINRA’s goal is to settle disputes quickly and efficiently without the standard procedural and discovery requirements that bog down cases filed in courts.

How Does Arbitration Work with FINRA?

Arbitration is an alternative to filing a case in civil court. Arbitration tends to be less formal and is designed to process claims more quickly than filing a lawsuit in court.

FINRA’s arbitration process involves resolving monetary disputes among brokers and investors. FINRA’s arbitrators can issue monetary judgments and have the authority to order a broker to deliver securities to you if that is a just resolution of the case.

An arbitration hearing is similar to a trial in court. The parties admit evidence and argue their side to a neutral person or panel of arbitrators who will decide the case. The arbitrator’s decision, called an award, is the judgment of the case and is final.

You should know that you do not have the right to appeal the award to another arbitrator. You may have an opportunity to pursue an appeal in court under limited circumstances. However, you cannot elect to arbitrate your case and then file a complaint in court seeking a trial on the issues decided by the arbitrator.

FINRA’s arbitration forum operates under the rules set forth by the SEC. FINRA ensures that the platform serves as it should and facilitates ending disputes. No member of FINRA participates in the arbitration. FINRA merely provides the forum and enforces the rules. Arbitrators decide the cases.

The arbitrators typically need about 16 months to issue an award. This is a lot quicker than court, where cases could take years to get to trial. The parties also have the opportunity to resolve the dispute by negotiating among themselves without going to arbitration.

FINRA’s Arbitration Forum Protects Investor Confidentiality

Arbitration with FINRA is often confidential. The parties can share information about their case if they choose. However, they do not have to do so. By contrast, court filings are public records. Any person could view the court file and learn all the private information contained in the pleadings.

The pleadings that the parties must file in FINRA arbitration cases are not public records. Notwithstanding, FINRA posts arbitration awards for anyone to see in its online database. The underlying pleadings remain confidential even though FINRA publishes the award online.

Posting the award online allows FINRA’s arbitration forum to have some transparency. Moreover, potential claimants and respondents contemplating using FINRA’s arbitration service can gauge which arbitrators they might select for their case.

What Are the Basic Attributes of FINRA Arbitration?

An arbitration hearing would look familiar to anyone who has participated in or observed a trial in court. The arbitrator or panel of arbitrators acts as a judge and/or jury in that the arbitrator plays the role of the fact-finder.

The parties present evidence in the form of testimony and documents and may even call expert witnesses to help the arbitrator understand any complex issues. The parties can cross-examine witnesses and call rebuttal witnesses as well.

The similarities between the court and arbitration end there. The parties can streamline their case if they want. Generally speaking, the more streamlined a case is, the quicker the arbitrator can announce an award. An arbitrator can decide less complex cases more quickly than complicated matters.

The parties can also submit their claim to the arbitrator “on the papers,” which means that the parties argue their cases in memoranda and provide supporting evidence for their position. The arbitrator renders a decision without testimony.

Another stark difference between a traditional court case and arbitration relates to discovery and motion practice. Parties have limited opportunity to depose witnesses before the arbitration hearing.

In civil court proceedings, each party deposes witnesses, propounds interrogatories, and requests documents from each other. Then, they move for summary judgment hoping that the judge decides the case without a trial.

Costs Associated with FINRA Arbitration

The parties engaged in FINRA arbitration can dispute discovery requests. However, seeking resolution of these requests costs the parties money. The total cost of FINRA arbitration depends on the work the parties request from the arbitrator.

The case will be less expensive for both parties if they work together to avoid unnecessary discovery disputes. Additionally, cases can proceed to arbitration faster because arbitrators do not hear motions for summary judgment. They decide the matter based on the facts and the applicable law in one hearing.

The person requesting FINRA arbitration must pay a filing fee. FINRA assesses a filing fee based on the complexity of the case, the type of relief sought, and whether the moving party is an individual investor, professional, or a firm with membership in FINRA.

Additionally, FINRA’s filing fees will change depending on whether the relief requested is for a sum certain, like a contract amount, or an undetermined amount of money. The arbitrator will spend less time on the case if the dispute involves a “sum certain” rather than an unknown amount.

It is important to note that FINRA accepts fee waivers if the filing fee causes an undue hardship. Additionally, FINRA can refund a portion of the fees collected in limited circumstances.

Suppose you believe that your stock broker’s or financial advisor’s acts or omissions caused you to lose money. In that case, you should contact a knowledgeable attorney with tremendous experience representing individual investors and helping them recover their losses.

Who Is Eligible to Arbitrate a Claim with FINRA?

FINRA does not accept every request for arbitration. The parties who request arbitration with FINRA must meet the appropriate criteria. However, some claimants must submit to arbitration.

FINRA will not provide a forum for every securities-related dispute. For individual investors, which FINRA calls “customers,” FINRA will accept your case for arbitration if:

- The dispute arose between an investor and either a company or individual financial advisor registered with FINRA or an individual investor and a brokerage firm; and

- The party filing an arbitration claim filed the claim within six years of the date the claim accrued.

FINRA may accept your request for arbitration if you satisfy both the requirements listed above.

Conversely, FINRA must accept your arbitration claim when:

- A written contract mandates all parties resolve their disputes through arbitration;

- The dispute arose between an individual investor and a brokerage or broker who is a member of FINRA; and

- The subject matter of the dispute involves securities.

According to FINRA’s rules, a brokerage or broker must submit their case to arbitration with FINRA when an individual investor requests arbitration.

FINRA will also accept arbitration cases involving employment discrimination if both parties agree to allow FINRA to arbitrate the claim.

Will an Arbitrator Decide Every Claim Submitted?

Initiating arbitration proceedings does not obligate the parties to bring the case to a decision by an arbitrator. Instead, they can negotiate a settlement if they choose before submitting the case to the arbitrators for a decision. Sometimes parties will present their case to a mediator to help them settle their dispute.

Like filing a case in court, parties are always free to negotiate among themselves to reach an agreeable resolution. Negotiating a settlement can save parties time and money.

Additionally, nothing said during negotiations can be used by one party against another. Therefore, parties can speak freely about their dispute without the fear of reprisal.

What Types of Cases Do FINRA Arbitrators Hear?

Understanding what types of claims FINRA arbitrators commonly hear may help you determine whether you should submit your claim to arbitration.

According to FINRA’s statistics, investors pursue the following causes of action before FINRA arbitrators:

- Breach of fiduciary duty,

- Negligence,

- Misrepresentation,

- Failing to supervise,

- Omission of material facts,

- Suitability,

- Blue Sky law violations,

- Manipulation,

- Errors-charges,

- Elder financial abuse,

- Execution error, and

- Errors in margin calls.

FINRA arbitrators acquire superior knowledge about the subject matter because they work with these principles of law all of the time. By contrast, a typical judge sitting in court may not have exposure to these problems. The judge might misunderstand some of the nuances of the securities business that a FINRA arbitrator would understand.

Does FINRA Arbitration Apply Only to Stocks?

Not every case that FINRA arbitrators hear involves stock transactions. In fact, FINRA arbitrators hear a variety of legal challenges. Some securities individual investors filed claims concerning:

- Purchasing and selling common stock,

- Real estate investment trusts (REIT),

- Business development companies,

- Buying and selling options,

- Buying and selling mutual funds,

- Private equity transactions,

- Limited partnership agreements,

- Variable and fixed annuities,

- Exchange-traded funds (ETF),

- Corporate and municipal bond transactions and funds,

- So-called “structured products,” and

- 401(k) portfolios.

An arbitration case could include more than one of these topics. FINRA arbitrators are well-versed in how these securities work, market pricing, risk assessment, and more.

Analysis of the FINRA Arbitration Process

Filing a claim for arbitration with FINRA is similar to filing a case in court. Each side has a chance to set out their claim, respond to the other party, request discovery, then arbitrate the case.

You should understand how an arbitration case proceeds from case filing to the decision and award process. We will examine each step closely so that you can decide if filing an arbitration case with FINRA is suitable for you. You should also understand the procedures you need to follow if you have an arbitration clause in your contract.

How to File an Arbitration Case with FINRA

Initiating arbitration begins with filing a document called a “statement of claim” with FINRA. FINRA calls the party who filed first the claimant. The party answering the claim is the respondent.

The statement of claim is similar to a complaint filed in civil court. The statement of claim should set forth enough information to notify the respondent as well as the arbitrator to:

- The identity of all relevant parties,

- The nature of the dispute,

- All relevant dates, and

- A demand for relief.

A claimant’s demand for relief is the remedy the claimant seeks by filing an arbitration claim. The claimant’s demand for relief should specify the type of relief desired, including the amount of monetary damages sought, interest, contract damages (liquidated damages), and specific performance of the contract, if applicable.

FINRA accepts claims filed through its online portal. FINRA accepts mailed documentation mailed as well.

FINRA will accept a case for arbitration if the claimant files a submission agreement and pays the required fee. Additionally, FINRA will review the statement of claim to determine if the claimant met all of the requirements. If not, FINRA will notify the claimant and give the claimant a chance to rectify the problem.

FINRA will officially serve the respondent with the papers filed by the claimant. The respondent will receive the statement of claim, attached documentation, and the submission agreement from FINRA.

Related Reads: How to File a Formal Complaint Against Your Financial Advisor

What Should You Expect When Your Broker Answers Your Claim?

FINRA grants the respondent 45 days to answer the claim. All respondents will file their answer to the suit with FINRA and serve a copy on the claimant. The respondent may serve documents upon the claimant that supports their position. Failing to answer a claim timely could result in FINRA defaulting the respondent.

FINRA’s rules allow the respondent to file counterclaims, cross-claims, and third-party claims as well. Therefore, the respondent can claim damages from you, another respondent, or a new party to the claim. The respondent would have the same opportunity to file these claims if the case went to court instead of arbitration.

The respondent will most likely deny that they committed any wrongdoing or caused you any damages. They might set out a complete defense or a partial defense. Either way, it is unlikely the respondent will agree with your statement of claim. You should expect that because arbitration is an adversarial process.

Selecting an Arbitrator for Your Claim

You cannot choose which judge hears your case when you file in court. Judges are assigned to sessions and hear the cases that come into their courtroom. Most courts assign cases to a session when processing the initial filings, and moving the case to another session is difficult.

You have some say over the arbitrators who hear your case. FINRA uses a Neutral List Selection System computer algorithm to derive a random list of arbitrators for your case out of its entire database of available arbitrators. The algorithm computes variables to derive a candidate list.

The parties choose the arbitrator who will preside over their case from the list provided by FINRA.

FINRA arbitrators act independently from FINRA. FINRA only provides a forum to resolve disputes; it has no stake in the outcome.

The Selection of Arbitrators Is Similar to Jury Selection

The number of arbitrators depends on the type of claim filed. FINRA’s rules dictate that either one or three arbitrators hear a claim.

The parties will have one arbitrator if the claim is worth up to $100,000. Each party will receive a list of 10 arbitrators. They can strike four arbitrators each from the list. From there, the parties can rank the remaining arbitrators if they choose. Then, FINRA will select the arbitrator from that list.

Cases involving damage claims exceeding $100,000 qualify for a panel of three arbitrators. In that case, FINRA distributes three lists. One of the names of the lists 10 chair-qualified public arbitrators, a second list identifies 15 public arbitrators, and the third list contains the names of 10 industry arbitrators.

The parties can select an all-public panel and rank them if they choose. Otherwise, they have the right to strike four arbitrators from the first list, six from the second, and all 10 from the third list.

Challenging Arbitrators “For Cause”

You can challenge an arbitrator “for cause,” just like you could challenge a member of a jury panel. FINRA allows litigants to challenge arbitrators for reasons such as:

- Bias or prejudice;

- Previously forming an opinion;

- Personal relationship with a party or related to a party by marriage or blood;

- Having a business relationship with a party;

- Involvement in litigation with one of the parties;

- Previous attorney-client relationship with the arbitrator;

- One of the parties accused the arbitrator of wrongdoing previously or requested an award be vacated;

- Having a financial stake in the case or financial interest in one of the parties; or

- Having testified as an expert for one of the parties within the previous five years or signed a retainer agreement within the last three years but not testifying.

FINRA will strike the arbitrator “for cause” from its list of arbitrators if it allows the party’s challenge. Allowing challenges assures all parties filing arbitration claims with FINRA that their arbitrators are neutral and detached. In turn, fairness and transparency lead to greater confidence in the FINRA arbitration procedures.

Pre-Hearing Conferences and Discovery

Arbitrators schedule pre-hearing conferences, similar to pre-trial hearings in court. FINRA schedules an initial pre-hearing conference with the parties and arbitration panel after FINRA names the panel. Pre-hearing conferences often occur remotely by either telephone conference or an internet-based conference program like Zoom or WebEx.

The purpose of the pre-hearing conference is to establish a timeline for the case. The parties will receive a schedule to complete their discovery requests and responses. The panel may set a briefing schedule at the time. Additionally, the panel will discuss whether the parties are amenable to mediation. The panel may select the hearing date at that time.

The arbitrators can schedule the final hearing date and set interim dates as well.

The panel will hear disputes regarding other preliminary matters after the initial hearing. The panel can listen to arguments on motions and discovery disputes as required.

How Does Discovery Proceed in FINRA Arbitration?

FINRA’s rules for discovery help the parties obtain information about each other and potential witnesses efficiently. FINRA’s discovery rules contain provisions that instruct each party to turn over documents and additional information to the other party. The process is streamlined and cost-effective. However, parties can request the other party produce specific documents in formal requests. Additionally, parties may object to producing specific papers and responding to other discovery requests.

Failing to comply with mandatory discovery could lead to sanctions levied on the offending party.

Unlike traditional court procedure, the parties must ask the arbitration panel to subpoena witnesses and produce documents in the custody of non-parties.

The Arbitration Hearing: Your Chance to Tell Your Story

An arbitration hearing is like a trial. The process will be familiar to you if you have ever participated in one. An arbitration hearing is a formal, solemn proceeding but lacks the rigidity of a trial in a courtroom.

The arbitration typically proceeds in the following manner:

- First, the arbitrators, parties, and all witnesses swear an oath;

- Then, the parties can, but need not, give opening statements;

- At that time, the claimant calls witnesses and presents evidence, and the respondent cross-examines the witnesses;

- Next, the respondent can call witnesses;

- The respondent presents cross-claims and counterclaims at this time as well;

- Either party may offer rebuttal evidence once the respondent rests;

- Thereafter, the parties give their closing arguments; and

- Finally, the arbitration panel sets a post-hearing schedule for briefing and then closes the record when all parties submit their filings.

Unlike most courtroom proceedings, witnesses may appear remotely, and the panel can spread the case out if necessary to accommodate people’s schedules within reason.

Arbitration Awards

By law, all arbitration panels must reduce the award to writing. They have no requirement to make findings of fact or rulings of law. The panel must issue an award within 30 days from the date they close the record. If more than one arbitrator heard the case, then a majority has to agree with the award.

The award will contain a summary of the issues presented, a ruling on the damages and other relief requested, and fees assessed if any. The parties can jointly request the panel for its rationale for the award in a document called an “explained decision.”

The losing party must pay the damages or provide the ordered relief within 30 days. The respondent can file a motion to vacate the award, which tolls the time for the respondent to pay the damages.

FINRA can sanction the respondent for non-payment of damages if the respondent does not comply with the ruling or appeal within 30 days.

Can the Losing Party Appeal?

FINRA’s arbitration rules do not permit an appeal. The party who wishes to appeal the award must do so in court. However, the law only allows appeals in certain instances. You cannot appeal an arbitrator’s award simply because you lost. Instead, you can appeal if:

- The award is tainted because of corruption, fraud, or undue influence;

- The arbitrators were either corrupt or partial toward the winning side;

- The arbitrators ruled unfairly on evidentiary issues causing significant prejudice to the proponent of the evidence;

- The arbitrators exceeded their authority;

- The arbitrators manifestly disregarded established law; or

- The losing party can show there is no factual or reasonable basis for the award.

Overturning an award on appeal is difficult. That is why it is vital to have an experienced FINRA arbitration lawyer argue your case for you.

Why Should You Choose the Law Offices of Robert Wayne Pearce, P.A., to Represent You in a FINRA Appeal?

There is no substitute for experience. FINRA arbitration attorney Robert Wayne Pearce has successfully represented numerous individuals in arbitration cases in his home state of Florida and across the Country. Robert and his team of knowledgeable attorneys understand what is at stake for you as a private investor.

With the Law Offices of Robert Wayne Pearce, P.A., protecting your interests, you can be assured that you have one of the most accomplished, reputable, and seasoned FINRA arbitration attorneys holding your broker, financial planner, or investment advisor liable for their misconduct.

Free Consultation with a Premiere FINRA Arbitration Lawyer

Robert Pearce is an industry leader. His tremendous experience and the verified track record of success he brings to work for you are invaluable.

Learn more about how the Law Offices of Robert Wayne Pearce, P.A. can help you get a just award by calling 561-556-2927 or toll-free at 866-489-9402. You can also contact us via e-mail.

Since 1980, the Law Offices of Robert Wayne Pearce, P.A., has recovered more than $175 million for investors. With over four decades of experience and success on your side, you stand the best chance to recover your investment with the Law Offices of Robert Wayne Pearce.