Port St Lucie Investment and Securities Fraud Cases

Port St. Lucie investors face unique challenges when dealing with investment fraud and securities violations. The Law Offices of Robert Wayne Pearce, P.A. provides comprehensive legal representation for investors who have suffered financial losses due to broker misconduct, unsuitable investment recommendations, or deceptive financial practices. Our firm represents individual investors, retirees, and institutional clients in securities arbitration matters before the Financial Industry Regulatory Authority (FINRA), as well as in Florida state and federal courts. We handle cases involving churning, unauthorized trading, breach of fiduciary duty, and failure to supervise throughout the Treasure Coast region.

Common Investment Fraud Issues in Port St. Lucie

Port St. Lucie investors often encounter sophisticated investment fraud schemes targeting the area’s growing retiree population. Financial advisors and brokers may recommend unsuitable investments such as high-risk annuities, illiquid REITs, or complex structured products that violate FINRA suitability rules. The rapid growth of Port St. Lucie has attracted both legitimate financial professionals and bad actors seeking to exploit unsuspecting investors. Common violations include overconcentration in speculative investments, excessive trading to generate commissions, and misrepresentation of investment risks.

How Our Port St. Lucie Investment Fraud Lawyers Help Recover Your Losses

The Law Offices of Robert Wayne Pearce, P.A. employs proven strategies to investigate misconduct and pursue recovery through FINRA arbitration or litigation. Our attorneys analyze trading patterns, review account statements, and identify regulatory violations to build strong cases for our clients. We understand the complexities of Florida securities law and federal regulations that protect investors.

Types of Securities Fraud We Handle

Unsuitable Investment Recommendations FINRA Rule 2111 requires brokers to recommend investments that match your financial situation and risk tolerance. We investigate cases where advisors ignored these obligations and pushed inappropriate products. Churning and Excessive Trading Brokers who trade excessively to generate commissions violate their duty to clients. Our attorneys analyze turnover ratios and cost-to-equity ratios to prove churning claims. Misrepresentation and Omissions Financial advisors must provide accurate information about investment risks and features. We pursue claims when brokers hide crucial facts or make false statements about investments. Breach of Fiduciary Duty Investment advisors owe the highest duty of care to their clients. Our firm holds advisors accountable when they place their interests ahead of yours. Failure to Supervise Brokerage firms must monitor their representatives’ activities. We target firms that fail to detect and prevent misconduct by their brokers. Elder Financial Exploitation Port St. Lucie’s senior population faces heightened risk of financial abuse. We work with families to recover assets misappropriated from elderly investors. Ponzi Schemes and Investment Scams Fraudulent investment schemes devastate victims’ finances. Our attorneys trace funds, coordinate with regulators, and pursue all available recovery avenues.

Why Port St. Lucie Investors Choose Our Securities Fraud Attorneys

The Law Offices of Robert Wayne Pearce, P.A. brings an impeccable track record of success to every Port St. Lucie investment fraud case we handle. Our firm focuses exclusively on securities litigation and arbitration, giving us deep expertise in this complex area of law. We understand how to navigate FINRA’s arbitration process and know which strategies produce results.

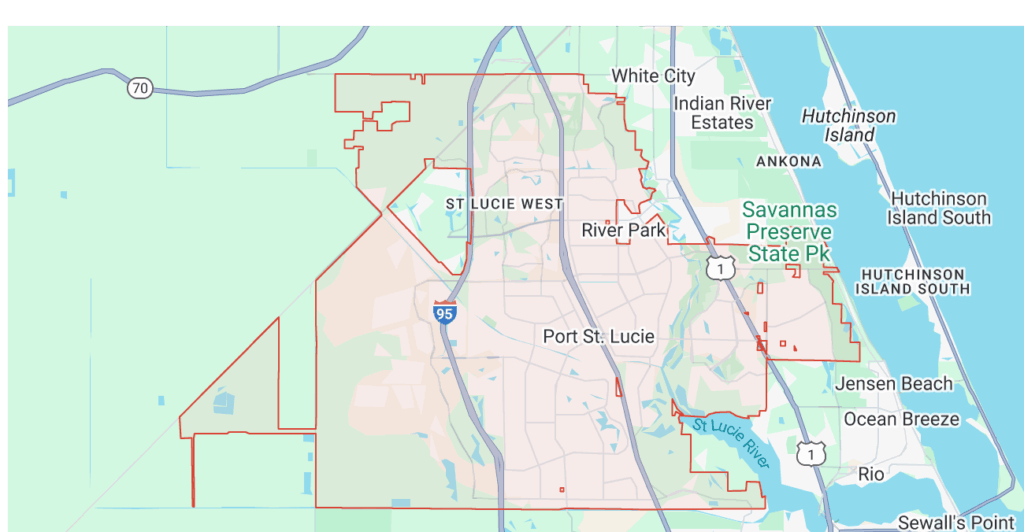

Strategic Location Serving the Treasure Coast

Port St. Lucie’s position in St. Lucie County makes it a hub for financial services along Florida’s Treasure Coast. Our attorneys serve investors throughout the region, including Stuart, Fort Pierce, Jensen Beach, and Vero Beach. We maintain strong relationships with local financial experts and forensic accountants who assist in building compelling cases. This regional network enhances our ability to investigate complex fraud schemes affecting Port St. Lucie investors.

Act Quickly to Protect Your Rights

Securities fraud claims have strict time limits. FINRA requires most claims to be filed within six years of the event giving rise to the claim. Florida law may impose shorter deadlines for certain types of claims. Contact our Port St. Lucie investment fraud attorneys immediately to preserve your rights and discuss

Frequently Asked Questions

What types of investment fraud are most common in Port St. Lucie?

Port St. Lucie investors frequently encounter unsuitable annuity sales, overconcentration in risky investments, and unauthorized trading. The area’s retiree population is often targeted with complex products that generate high commissions but provide poor returns.

How long do I have to file an investment fraud claim?

FINRA arbitration claims must typically be filed within six years of the occurrence or event giving rise to the claim. However, some claims may have shorter deadlines under Florida law, making it crucial to consult an attorney promptly.

What evidence do I need to prove investment fraud?

Key evidence includes account statements, trade confirmations, correspondence with your broker, and account opening documents. Our attorneys help gather additional evidence through the discovery process to strengthen your case.

How much does it cost to hire a Port St. Lucie investment fraud attorney?

The Law Offices of Robert Wayne Pearce, P.A. handles most investment fraud cases on a contingency fee basis. You pay no attorney fees unless we successfully recover compensation for your losses, and initial consultations are always free.

Can I still pursue a claim if my broker has left the industry?

Yes, you can still file a claim against the brokerage firm that employed the broker. Firms remain liable for their representatives’ misconduct under the legal doctrine of respondeat superior and their duty to supervise.

Free Consultation with a Port St. Lucie Securities Attorney

Attorney Robert Wayne Pearce personally reviews every potential case to determine the best path forward. Our initial consultations are free and completely confidential. We work on a contingency fee basis for most investment fraud cases. This means you pay no attorney fees unless we recover compensation for your losses. Call our Port St. Lucie investment fraud lawyers at (800) 732-2889 or submit our online consultation form. Let us put our experience to work recovering your investment losses.