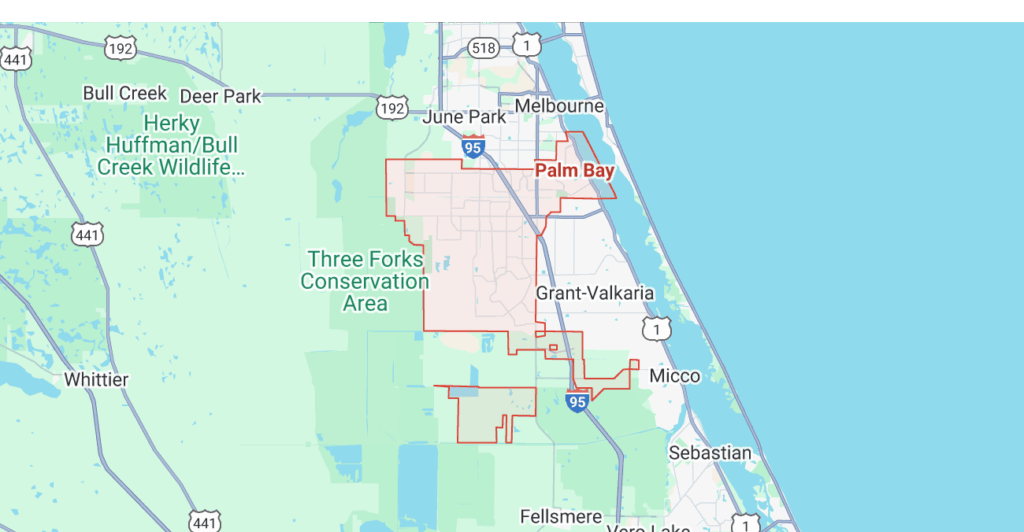

Palm Bay Investment and Securities Fraud Cases

Palm Bay investors deserve honest financial advice and ethical broker conduct. The Law Offices of Robert Wayne Pearce, P.A. protects Space Coast residents who have suffered investment losses from stockbroker fraud, unsuitable recommendations, or deceptive financial practices.

Our firm pursues recovery through FINRA arbitration, SEC investigations, and Florida state court actions against broker-dealers and investment advisors who violate securities laws.

Common Investment Fraud Schemes in Palm Bay

Retirees and aerospace professionals in Brevard County face targeted financial fraud. Dishonest brokers exploit the area’s growing population of seniors and tech workers with complex products that generate high commissions but devastate portfolios.

Palm Bay residents frequently encounter unsuitable variable annuities, non-traded REITs, structured products, and speculative alternative investments pushed without proper risk disclosure.

How Our Palm Bay Investment Fraud Lawyers Help You Recover Losses

The Law Offices of Robert Wayne Pearce, P.A., investigates broker misconduct using forensic analysis of trading records. We build compelling claims based on regulatory violations, breach of fiduciary duty, and Florida securities statutes.

Our attorneys handle cases involving:

Unsuitable Investment Recommendations

FINRA Rule 2111 requires brokers to recommend only investments that match your risk tolerance and financial goals. We prove suitability violations by comparing your stated objectives to the actual investments sold.

Churning and Excessive Trading

Commission-driven trading that benefits the broker more than the client violates securities regulations. Our analysis reveals patterns of unnecessary transactions designed to generate fees.

Misrepresentation and Omissions

Florida Statute 517.301 prohibits false statements or concealment of material facts in securities transactions. We document how brokers misled you about investment risks or returns.

Breach of Fiduciary Duty

Investment advisors owe clients a fiduciary obligation to act in their best interests. Self-dealing, hidden conflicts, and preferential treatment of other clients breach this sacred trust.

Overconcentration

Prudent investment practice requires diversification across asset classes and sectors. Concentrating your portfolio in a single stock, sector, or strategy exposes you to unnecessary risk.

Failure to Supervise

Brokerage firms must monitor their representatives’ activities under FINRA Rule 3110. When supervisors ignore red flags, the firm bears responsibility for resulting investor losses.

Elder Financial Exploitation

Florida’s vulnerable adult statutes provide enhanced protections for seniors targeted by financial predators. We help families recover assets stolen through manipulation or undue influence.

Ponzi Schemes and Investment Scams

Fraudulent investment programs promise guaranteed returns while using new investor money to pay earlier participants. Our team traces funds and coordinates with regulators to maximize recovery.

Why Choose Our Palm Bay Securities Attorneys

Attorney Robert Wayne Pearce has recovered for defrauded investors nationwide through aggressive representation and strategic negotiation.

We understand the unique challenges facing Palm Bay investors, from aerospace employees targeted with complex derivatives to retirees sold inappropriate annuities at local seminars.

The FINRA Arbitration Process for Palm Bay Investors

Most investment disputes are resolved through FINRA’s mandatory arbitration system rather than the court. This streamlined process typically concludes within 12-16 months, significantly faster than traditional litigation.

Our experienced arbitration attorneys guide you through claim filing, discovery, hearing preparation, and settlement negotiations to maximize your recovery potential.

Act Now to Protect Your Rights

Securities claims face strict time limits under both FINRA rules and Florida law. FINRA generally requires filing within six years of the transaction, while Florida’s statute of limitations may be even shorter.

Delay jeopardizes your ability to recover losses, as evidence disappears and witnesses become unavailable over time.

Frequently Asked Questions

What types of investment fraud cases do you handle in Palm Bay?

We handle all securities fraud matters, including unsuitable recommendations, churning, unauthorized trading, Ponzi schemes, breach of fiduciary duty, and elder financial exploitation. Our Palm Bay investment fraud attorneys have experience with stocks, bonds, mutual funds, annuities, REITs, and alternative investments.

How long do I have to file an investment fraud claim?

Time limits vary depending on the type of claim and forum. FINRA arbitration claims must generally be filed within six years of the occurrence, while Florida court actions may have shorter deadlines. Contact us immediately for a free case evaluation to preserve your rights.

What evidence do I need for an investment fraud case?

Account statements, trade confirmations, correspondence with your broker, and account opening documents form the foundation of most cases. Our attorneys know how to obtain additional evidence through the discovery process, even if you lack complete records.

How much does it cost to hire a Palm Bay investment fraud lawyer?

The Law Offices of Robert Wayne Pearce, P.A., represents most investment fraud victims on a contingency fee basis. You pay no attorney fees unless we recover compensation for your losses. We offer free initial consultations to evaluate your potential claims.

Can I sue my broker if I signed an arbitration agreement?

Most brokerage account agreements require arbitration instead of court litigation. This actually benefits investors through faster resolution and lower costs. Our attorneys are skilled FINRA arbitration advocates who regularly achieve substantial awards for clients.

Contact Our Palm Bay Investment Fraud Attorney Today

Don’t let investment fraud destroy your financial security. The Law Offices of Robert Wayne Pearce, P.A., offers free, confidential consultations to evaluate your potential claims.

Call (800) 732-2889 or complete our online contact form to speak with Attorney Robert Wayne Pearce about your investment losses. We represent clients throughout Brevard County and the Space Coast on a contingency basis.