Mascotte Investment and Securities Fraud Cases

The Law Offices of Robert Wayne Pearce, P.A. represents clients in Mascotte who have suffered investment losses due to broker misconduct, including unauthorized trading, unsuitable recommendations, Ponzi schemes, and misrepresentation. The firm pursues recovery through FINRA arbitration, civil litigation, and direct negotiations with brokerage firms.

Robert Wayne Pearce and his team regularly assist Mascotte investors facing losses from excessive trading, margin abuse, private placement fraud, and other deceptive practices. They focus on holding financial professionals accountable and guiding clients through every step of the recovery process.

The firm typically works on a contingency fee basis but offers hourly and alternative arrangements when needed.

Guidance From a Seasoned Securities Fraud Law Firm

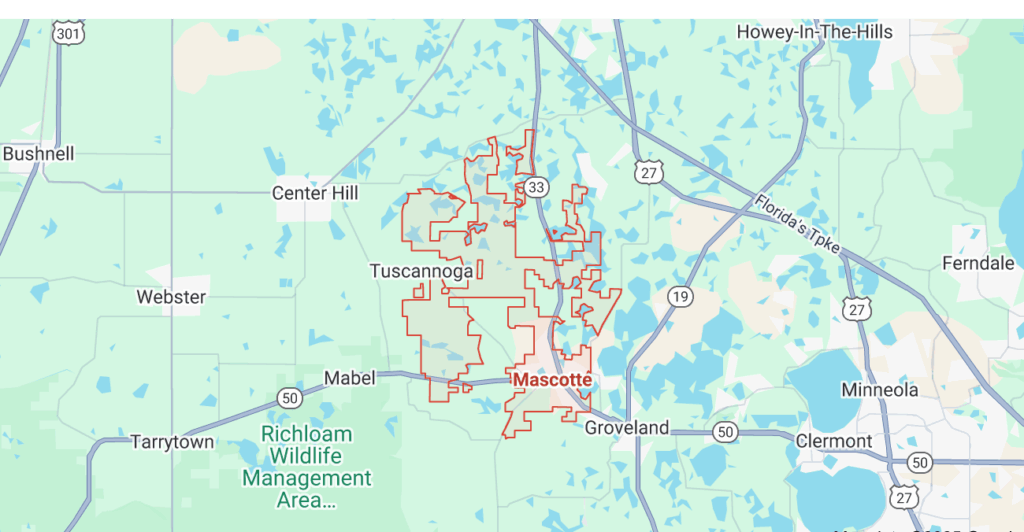

We routinely represent investors in Mascotte and understand both Florida statutes and the local financial landscape. If you suspect wrongdoing, contact us for a no‑cost consultation.

Searching for an investment fraud or securities fraud attorney “near me” might not always get you the best attorney for your case. That said, we represent clients nationwide and have represented investors near you in Mascotte and the greater Orlando area.

From safeguarding high‑value retirement portfolios to recovering losses in smaller accounts, we guide clients through FINRA arbitration, SEC inquiries, and related proceedings across Mascotte’s growing residential communities:

- Sunset Lake Estates – A newer lakeside subdivision attracting physicians and tech entrepreneurs diversifying into growth stocks; concentration risk here can lead to unsuitable investment claims.

- Gardens at Lake Jackson Ridge II – Upscale single‑family homes often purchased by mid‑career executives using rollover IRAs; vigilance is needed to detect unauthorized trading or margin misuse.

- Shearwater Estates – Gated community popular with relocating retirees seeking income‑producing bonds; exposure to high‑fee private placements may raise breach‑of‑fiduciary‑duty issues.

- Woodbury – Family‑oriented enclave with small‑business owners who may rely heavily on one advisor; churning and excessive commission schemes are common fraud risks.

Crafting a Strategy for Your Securities Fraud Case

Every claim is different. Our team investigates the specifics of your situation and designs a strategy tailored to your goals. With deep knowledge of securities rules, we strive for the strongest possible outcome.

Contact the Mascotte Investment and Securities Fraud Attorneys at the Law Offices of Robert Wayne Pearce, P.A Today

Don’t let fraud jeopardize your financial goals. At the Law Offices of Robert Wayne Pearce, P.A., we’re here to help you work toward recovering your losses.

Call the investment fraud recovery and FINRA arbitration lawyers at the Law Offices of Robert Wayne Pearce, P.A. at (800) 732‑2889 or fill out the free consultation form on the right to connect with an attorney today. There’s no obligation, and we keep all inquiries strictly confidential.

Written by attorney Robert Wayne Pearce

Mascotte securities fraud attorney

Stockbroker misconduct lawyer serving Mascotte Florida

Ponzi scheme investment loss attorney Mascotte

Mascotte undue influence and fiduciary breach lawyer

Leveraged metals and forex fraud attorney Mascotte Florida