Newberry Investment and Securities Fraud

The Law Offices of Robert Wayne Pearce, P.A. represents clients in Newberry who have suffered investment losses due to broker misconduct, including unauthorized trading, unsuitable recommendations, and Ponzi schemes. Attorney Robert Pearce helps investors in Newberry recover funds through FINRA arbitration, settlement negotiations, or litigation.

The firm handles claims involving churning, margin violations, private placement fraud, and misrepresentation. Robert Wayne Pearce, P.A. focuses on protecting clients located in Newberry by enforcing their rights under federal and state securities laws.

We usually work on a contingency fee basis, but hourly or alternative arrangements are available if needed.

Guidance From Seasoned Securities Fraud Counsel

We serve investors throughout Newberry and have deep familiarity with Florida’s securities laws, including the Florida Securities and Investor Protection Act (Fla. Stat. § 517.301) and remedies available under the Florida Deceptive and Unfair Trade Practices Act. If you believe your portfolio was mishandled, call for a free consultation.

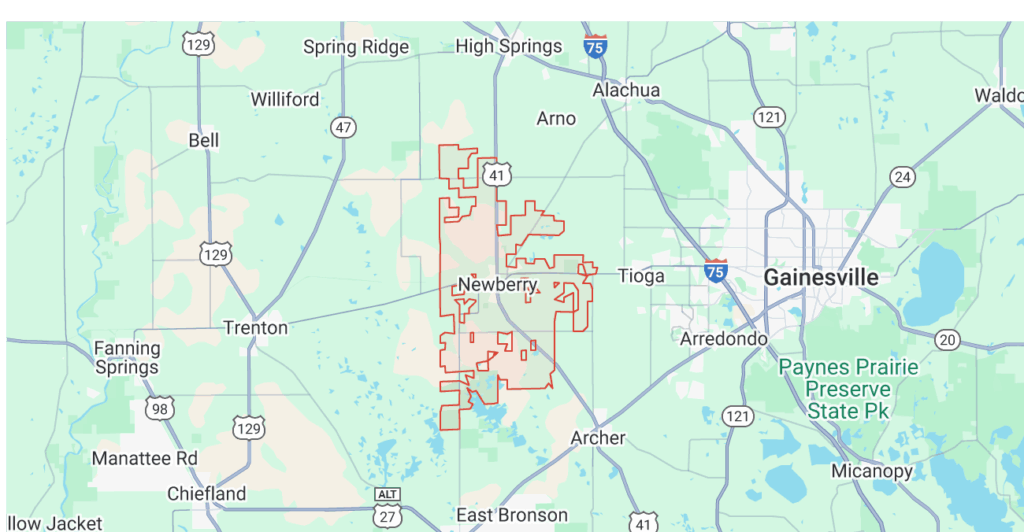

Searching for an investment fraud or securities fraud attorney “near me” might not always get you the best attorney for your case. That said, we represent clients nationwide and have represented investors near you in Newberry and the greater Gainesville area.

From complex high‑net‑worth accounts to retirement savings that still deserve protection, we regularly guide clients through FINRA arbitration, mediation, and other recovery avenues in and around Newberry:

- Town of Tioga – Master‑planned community attracting tech executives and medical professionals with concentrated equity positions; concentrated‑position risk can invite unsuitable diversification advice or over‑leveraging schemes.

- Arbor Greens – Upscale single‑family enclave popular with dual‑income households who rely on managed accounts; fee‑based “reverse churning” and hidden mark‑ups are common hazards.

- Wyndsong – Gated luxury homes favored by business owners exiting private companies; liquidity events may expose residents to private placement or Regulation D offerings that are misrepresented.

- Laureate Village & Jonesville Estates – Growing executive corridors where long‑term retirement assets can suffer from unauthorized margin use or excessive options trading.

A Tailored Plan for Your Investment Fraud Claim

Every matter is different. Our attorneys dig into the specifics of your account, apply Florida’s investor‑protection statutes, and design a recovery strategy focused on your objectives.

Contact the Newberry Investment and Securities Fraud Attorneys at the Law Offices of Robert Wayne Pearce, P.A Today

Don’t let fraud jeopardize your financial goals. At the Law Offices of Robert Wayne Pearce, P.A., we’re here to help you work toward recovering your losses.

We’ve recovered more than $175 million for our clients, establishing ourselves as determined advocates for investor rights, and with over 45 years of experience in securities law, our firm has tackled some of the most complex regulations that govern investments.

Call the investment fraud recovery and FINRA arbitration lawyers at the Law Offices of Robert Wayne Pearce, P.A. at (800) 732-2889 or fill out the free consultation form on the right to connect with an attorney today. There’s no obligation, and we keep all inquiries strictly confidential.

Written by attorney Robert Wayne Pearce

Newberry securities fraud attorney

Stockbroker negligence lawyer serving Newberry, Florida

Ponzi scheme recovery law firm Newberry FL

Newberry undue influence investment loss attorney

Leveraged metals and FOREX fraud lawyer in Newberry