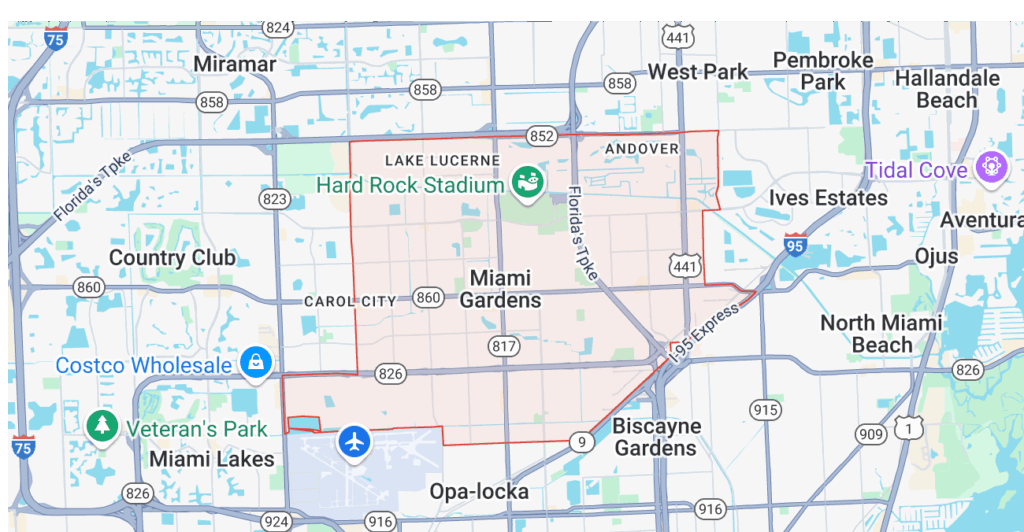

Miami Gardens Investment and Securities Fraud Cases

Miami Gardens investors deserve honest financial guidance. The Law Offices of Robert Wayne Pearce, P.A., represents victims of investment fraud throughout Miami Gardens and South Florida in securities arbitration and recovery matters. Our firm handles claims before FINRA, the AAA, and in state and federal courts. We pursue recovery for losses caused by broker misconduct, unsuitable investments, and deceptive financial practices.

How Miami Gardens Investment Fraud Attorneys Protect Your Financial Future

Investment fraud devastates families and businesses in Miami Gardens every day. Our securities attorneys investigate misconduct, build strong legal claims, and fight for maximum recovery through arbitration or litigation. Common violations we handle include churning, unauthorized trading, misrepresentation, breach of fiduciary duty, and failure to supervise. Each case requires careful analysis of account statements, trading records, and regulatory compliance.

Types of Investment Fraud Cases We Handle in Miami Gardens

Unsuitable Investment Recommendations

Brokers must match investments to your financial goals and risk tolerance. We review account documents and trading patterns to prove when recommendations violated FINRA suitability rules. Many Miami Gardens retirees lose life savings to unsuitable high-risk investments. Our attorneys recover damages when brokers ignore client objectives for personal gain.

Churning and Excessive Trading

Commission-driven trading destroys portfolio value through unnecessary fees. We analyze turnover rates and cost-to-equity ratios to establish churning claims under FINRA rules. Florida law provides additional protections against abusive trading practices. Our firm combines state and federal violations to maximize your recovery options.

Misrepresentation and Omissions

Brokers cannot hide investment risks or make false promises about returns. We document misrepresentations through recorded calls, emails, and marketing materials. Material omissions about fees, risks, or conflicts of interest violate securities laws. Our attorneys hold brokers accountable for both spoken and written deceptions.

Breach of Fiduciary Duty

Investment advisors owe the highest duty of care to Miami Gardens clients. We pursue claims when advisors prioritize commissions over client interests. Conflicts of interest must be disclosed before any transaction. Our firm investigates hidden compensation arrangements and undisclosed financial incentives.

Elder Financial Exploitation

Senior investors face targeted schemes designed to drain retirement accounts. We work with families to recover assets stolen through elder financial abuse. Florida’s elder exploitation laws provide enhanced remedies for vulnerable investors. Our attorneys coordinate with adult protective services when appropriate.

Ponzi Schemes and Investment Scams

Fraudulent investment schemes promise guaranteed returns to lure Miami Gardens victims. We trace funds, identify assets, and pursue all available recovery sources. Early action improves recovery chances in pyramid and Ponzi schemes. Contact our office immediately if you suspect investment fraud.

The Miami Gardens Investment Fraud Recovery Process

Recovery begins with a thorough case evaluation by experienced securities attorneys. We review your investment history, analyze losses, and identify all potential defendants.

Our process includes:

1. Free consultation to assess your claim

2. Investigation of broker records and firm compliance

3. Filing of FINRA arbitration or court complaint

4. Discovery to uncover hidden evidence

5. Negotiation or trial to maximize recovery. Most investment fraud cases are resolved through FINRA arbitration rather than the courts. Our attorneys have decades of arbitration experience before industry panels.

Why Choose Our Miami Gardens Investment Fraud Lawyers

Attorney Robert Wayne Pearce brings over 45 years of securities law experience to every case. Our firm has recovered more than $175 million for defrauded investors nationwide. We understand the tactics brokers use to exploit Miami Gardens investors. Our deep knowledge of securities regulations helps level the playing field against major brokerage firms. Local presence matters in investment fraud cases. We maintain offices throughout Florida and understand the unique challenges facing Miami Gardens residents.

Act Now to Protect Your Legal Rights

Investment fraud claims face strict time limits under state and federal law. FINRA requires arbitration filing within six years of the fraudulent transaction. Florida’s statute of limitations may be even shorter for certain claims. Delay can permanently bar your right to recovery.

Contact a Miami Gardens Investment Fraud Attorney Today

Don’t let investment fraud destroy your financial security. The Law Offices of Robert Wayne Pearce, P.A., offers free, confidential consultations to evaluate your claim. Call (800) 732-2889 or submit our online form to speak with an experienced Miami Gardens investment fraud attorney. We’ll review your case and explain all available recovery options.

Frequently Asked Questions

What types of investment fraud are most common in Miami Gardens?

The most common types include unsuitable investment recommendations, churning, unauthorized trading, and Ponzi schemes. Miami Gardens retirees often face targeted fraud involving annuities, promissory notes, and cryptocurrency scams. Our attorneys also see frequent cases involving overconcentration in risky assets and failure to diversify portfolios properly.

How long do I have to file an investment fraud claim?

FINRA arbitration claims must be filed within six years of the fraudulent event. Florida state law claims may have shorter deadlines, sometimes as brief as two years from discovery. Acting quickly preserves evidence and witness memories. Contact our office immediately for a time-limit analysis of your specific case.

What damages can I recover in an investment fraud case?

Recoverable damages typically include your actual investment losses, interest, and sometimes attorney fees. In cases involving elder abuse or egregious misconduct, punitive damages may be available. Our Miami Gardens investment fraud attorneys fight for full compensation, including consequential damages when appropriate.

How much does it cost to hire an investment fraud attorney?

The Law Offices of Robert Wayne Pearce, P.A., offers free initial consultations to evaluate your claim. We handle most investment fraud cases on a contingency fee basis. This means you pay no attorney fees unless we recover compensation for you. We’ll discuss all fee arrangements during your confidential consultation.

Can I file a claim if my broker has left the industry?

Yes, you can still pursue recovery even if your broker is no longer registered. The brokerage firm remains liable for supervising its representatives and may have insurance coverage. Our attorneys pursue all responsible parties, including the firm, branch managers, and compliance officers who failed to prevent the fraud.