Cape Coral Investment and Securities Fraud

The Law Offices of Robert Wayne Pearce, P.A. represents clients in Cape Coral who have suffered losses due to investment fraud or broker misconduct. We handle claims involving unauthorized trading, Ponzi schemes, excessive commissions, and unsuitable investment recommendations.

Our attorneys regularly represent clients in Cape Coral through FINRA arbitration, mediation, and litigation in both state and federal courts. We also assist with claims involving violations of federal securities laws and Florida’s investor protection statutes.

The Law Offices of Robert Wayne Pearce, P.A. focuses on helping Cape Coral investors pursue recovery through every available legal channel. We typically work on a contingency fee basis but offer hourly or alternative arrangements when needed.

Support for Cape Coral Investors from Our Skilled Securities Fraud Lawyers

We have extensive knowledge of Florida laws and the hurdles that Cape Coral investors may face. If you suspect you’ve been wronged, call us for a no-cost consultation.

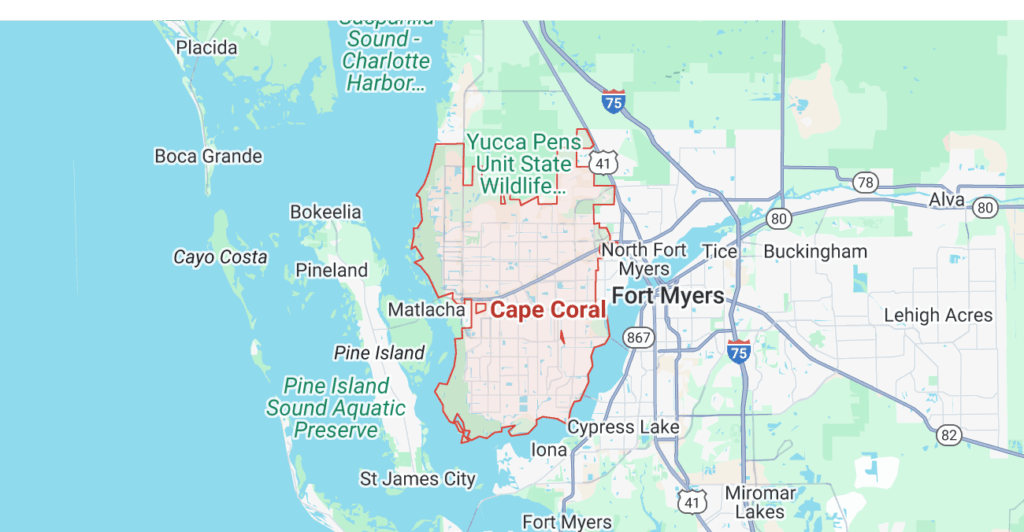

Searching for an investment fraud or securities fraud attorney “near me” might not always get you the best attorney for your case. That said, we represent clients nationwide and have represented investors near you in Cape Coral and the greater Fort Myers area.

Portfolios in this area can be substantial, and maintaining them often requires trustworthy management. Some neighborhoods around the city where you might reside include:

- Cape Harbour – An upscale, gated waterfront community featuring marina amenities and luxury residences, where sophisticated portfolios may be exposed to offshore investment scams and complex securities misrepresentations.

- Pelican Isles – A prestigious waterfront enclave renowned for high-end homes and affluent residents, with investor profiles that could attract fraudulent schemes targeting exclusive recreational or alternative investment vehicles.

- Four Points – A refined neighborhood offering resort-like amenities and a blend of local and international investors, where intricate financial instruments and multi-million-dollar portfolios can be vulnerable to misrepresented asset performance and Ponzi schemes.

- Island City Estates – A stately community of custom-built estates favored by discerning high-net-worth investors, where sophisticated real estate investment strategies may face risks from deceptive asset valuations and elaborate investment fraud schemes.

A Tailored Plan for Your Case

We recognize that every situation is unique. Our attorneys investigate the details of your claim and develop a plan designed specifically for your needs. With our in-depth understanding of securities regulations, we’re committed to securing the strongest possible outcome for you.

Contact Our Cape Coral Investment Fraud and Securities Arbitration Attorneys Today

Don’t let fraud jeopardize your financial goals. At the Law Offices of Robert Wayne Pearce, P.A., we’re here to help you work toward recovering your losses.

With over 45 years of experience in securities law, our firm has tackled various complex regulations that govern investments.

We’ve already recovered more than $175 million for our clients, establishing ourselves as determined advocates for investor rights.

Call our Cape Coral investment and securities fraud lawyers at (800) 732-2889 or fill out the free consultation form on the right to connect with an attorney near you. There’s no obligation, and we keep all inquiries confidential.

Whether you reside in Eight Lakes or Rose Garden, our team is ready to stand up for you.

Written by attorney Robert Wayne Pearce

Cape Coral securities fraud attorney for retail investors.

Stockbroker misconduct lawyer serving Cape Coral FL.

Ponzi scheme recovery law firm Cape Coral Florida.

Cape Coral commodities fraud & leveraged metals dispute attorney (niche).

Investment loss lawyer Cape Coral – undue influence in estate-linked investments (niche).