Bradenton Investment and Securities Fraud

The Law Offices of Robert Wayne Pearce, P.A. represents investors in Bradenton who have suffered losses due to broker misconduct or securities fraud. We handle cases involving unauthorized trading, excessive commissions, Ponzi schemes, and other financial wrongdoing.

Our firm pursues recovery through FINRA arbitration, court litigation, and other dispute resolution channels. Robert Wayne Pearce and his team regularly assist clients located in Bradenton with claims against brokerage firms and financial advisors.

We typically work on a contingency fee basis, but also offer hourly and alternative fee arrangements when appropriate.

Support for Bradenton Investors from Our Skilled Securities Fraud Lawyers

We have extensive knowledge of Florida laws and the hurdles that Bradenton investors may face. If you suspect you’ve been wronged, call us for a no-cost consultation.

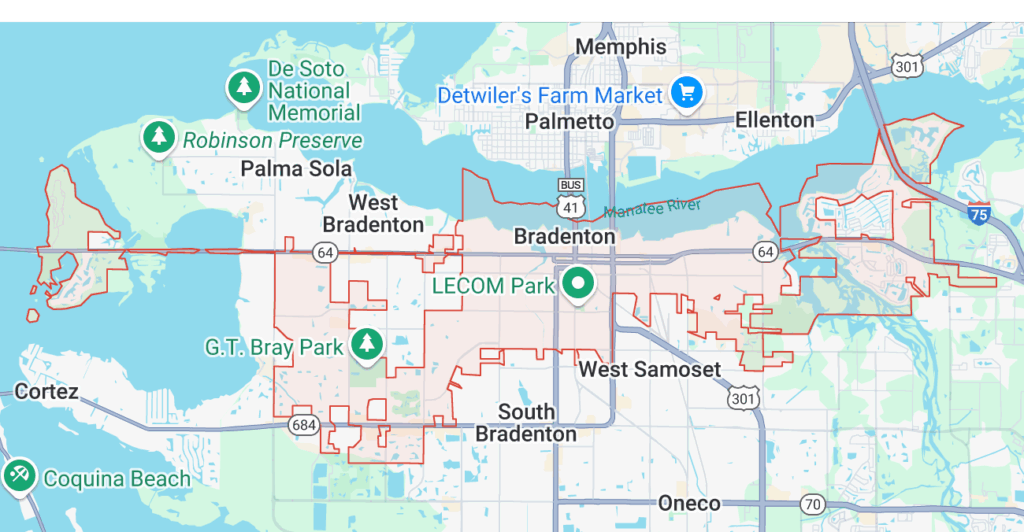

Searching for an investment fraud or securities fraud attorney “near me” might not always get you the best attorney for your case. That said, we represent clients nationwide and have represented investors near you in Bradenton and the greater Sarasota area.

Portfolios in this area can be substantial, and maintaining them often requires trustworthy management. Some neighborhoods around the city where you might reside include:

- Lakewood Ranch – A master-planned community renowned for its upscale residences and diverse luxury properties attracting high-net-worth individuals, where sophisticated investment fraud schemes may target extensive portfolios.

- Bradenton Beach – A coastal enclave featuring high-end waterfront estates favored by international investors and seasonal buyers, which can be vulnerable to cross-border securities violations and fraudulent real estate deals.

- River Oaks – An elegant riverfront neighborhood blending long-term professionals with seasonal investors, presenting potential risks from misrepresented investment opportunities and real estate fraud.

- Bay Isles – An exclusive waterfront area popular among affluent families and private equity enthusiasts, where complex investment structures might obscure unauthorized trading or mismanagement.

- The Reserve at River Run – A gated community offering premium residences for specialized investors, with inherent risks from unauthorized trading and sophisticated fraud schemes targeting exclusive financial portfolios.

A Tailored Plan for Your Case

We recognize that every situation is unique. Our attorneys investigate the details of your claim and develop a plan designed specifically for your needs. With our in-depth understanding of securities regulations, we’re committed to securing the strongest possible outcome for you.

Contact Our Bradenton Investment Fraud and Securities Arbitration Attorneys Today

Don’t let fraud jeopardize your financial goals. At the Law Offices of Robert Wayne Pearce, P.A., we’re here to help you work toward recovering your losses.

With over 45 years of experience in securities law, our firm has tackled various complex regulations that govern investments.

We’ve already recovered more than $175 million for our clients, establishing ourselves as determined advocates for investor rights.

Call our Bradenton investment and securities fraud lawyers at (800) 732-2889 or fill out the free consultation form on the right to connect with an attorney near you. There’s no obligation, and we keep all inquiries confidential.

Whether you reside in Bradenton Beach or Coral Shores, our team is ready to stand up for you.

Written by attorney Robert Wayne Pearce

Bradenton securities fraud attorney

Stockbroker negligence lawyer serving Bradenton Florida

Ponzi scheme recovery lawyer Bradenton

Bradenton prudent investor rule violation attorney

Bradenton undue influence investment litigation law firm