McKinney Investment and Securities Fraud

The McKinney investment fraud lawyers at the Law Offices of Robert Wayne Pearce, P.A. represent investors who have suffered losses due to broker misconduct, Ponzi schemes, unauthorized trading, and other forms of financial fraud.

Robert Pearce and his team assist clients in McKinney by pursuing recovery through FINRA arbitration, civil litigation, and strategic settlements. They routinely handle claims involving private-placement fraud, churning, and violations of the Texas Securities Act §33.

The firm works to hold negligent brokers and firms accountable while protecting investor rights under both state and federal law. Most cases are handled on a contingency fee basis, though hourly and other arrangements are available.

Decades of Securities Fraud Experience for Local Investors

We represent McKinney‑based investors and draw on detailed knowledge of the Texas Securities Act and Texas State Securities Board enforcement hurdles. If you suspect wrongdoing, call us for a no‑cost consultation.

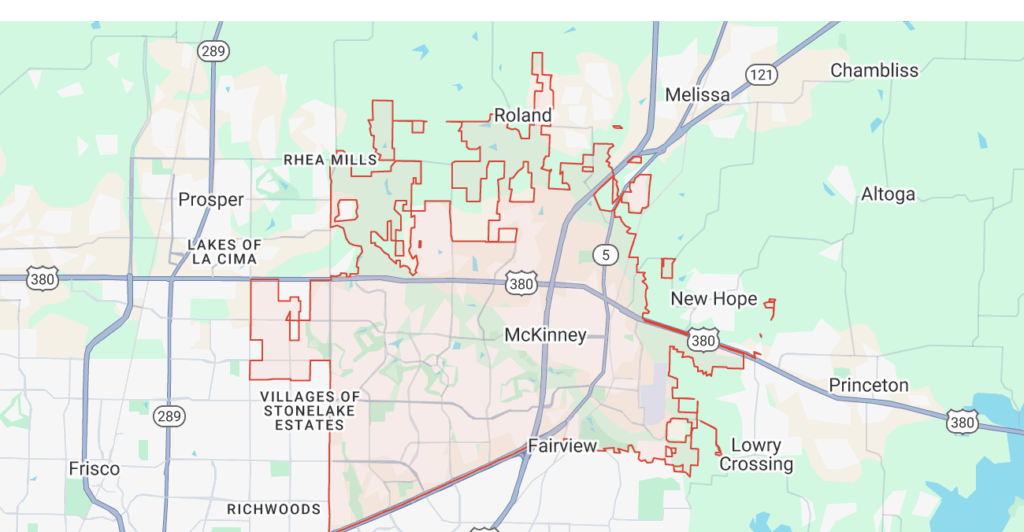

Searching for an investment fraud or securities fraud attorney “near me” might not always get you the best attorney for your case. That said, we represent clients nationwide and have represented investors near you in McKinney and the greater Plano area.

From fraud in high‑net‑worth portfolios to modest retirement accounts, we guide clients through FINRA arbitration, Texas State Securities Board complaints, and other legal avenues to help recover losses throughout McKinney:

- Stonebridge Ranch – A master‑planned golf‑course community where sizable managed portfolios can be exposed to churning or unsuitable REIT recommendations.

- Adriatica Village – European‑inspired mixed‑use district attracting entrepreneurs investing in real‑estate partnerships, which may be misrepresented through private placements.

- Craig Ranch – A corporate and PGA‑anchored hub with many rollover‑retirement accounts vulnerable to excessive variable‑annuity switching.

- Tucker Hill & Trinity Falls – Family‑oriented master‑planned areas where residents often rely on advisors for college‑savings plans—making misappropriation of 529 funds or unsuitable growth‑fund sales a concern.

Developing a Strategy Built Around Your Claim

Every case is different. Our attorneys review the unique facts of your situation and craft a plan to pursue the strongest possible outcome while navigating Texas Blue‑Sky laws and FINRA rules.

Contact the McKinney Investment and Securities Fraud Attorneys at the Law Offices of Robert Wayne Pearce, P.A Today

Don’t let fraud jeopardize your financial goals. At the Law Offices of Robert Wayne Pearce, P.A., we’re here to help you work toward recovering your losses.

We’ve recovered more than $175 million for our clients, establishing ourselves as determined advocates for investor rights, and with over 45 years of experience in securities law, our firm has tackled some of the most complex regulations that govern investments.

Call the investment fraud recovery and FINRA arbitration lawyers at the Law Offices of Robert Wayne Pearce, P.A. at (800) 732‑2889 or fill out the free consultation form on the right to connect with an attorney today. There’s no obligation, and we keep all inquiries strictly confidential.

Written by attorney Robert Wayne Pearce

McKinney securities fraud attorney

Stockbroker negligence lawyer serving McKinney TX

Ponzi scheme recovery law firm McKinney

Undue influence investment loss attorney McKinney Texas

Leveraged precious metals fraud lawyer McKinney TX